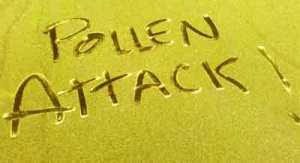

Living in the south, we have a love-hate relationship with spring. Sure I love the warming temps and first blooms of my Camellia bush and dogwoods, but the pollen literally blankets everything causing allergic reactions to man and beast alike. My black car looks yellow, 5 minutes after I spray it off!

Spring has brought the same love-hate feeling to the markets too. 1%+ daily moves up and down in the market have been occurring frequently since February.Emotional reactions to headlines are driving daily actions more than economic and corporate data.

Like the yellow pollen blanket, this too will pass.

Like the yellow pollen blanket, this too will pass.

In my January 2018 Market Update ‘Can the Party Continue?’ I wrote: “Earnings are THE signal to watch for…I expect earnings for the quarter ending this March (which start reporting in April) to be the first major hurdle to stocks. YOY earnings will be tough to beat as Q1 2017 was one of the strongest earnings season’s since 2011 according to numerous articles.” Think of the market’s sudden drop in reaction to a headline like an allergic sneeze. It can be painful, for a moment.

Damn the Tariffs, Earnings Ahead.

While the market has recently been “sneezing” at tariffs, in the end, it’s really about the potential impact on earnings. So far analysts have not issued any downward revisions to corporate earnings expectations for the upcoming quarter. The question is not “will earnings be good this quarter” but “will earnings be as strong as the same quarter a year ago, and will the forecast be rosy?”. Unlike the great Meatloaf song, “Two Out Of Three Ain’t Bad”, if all three (actual earnings vs estimates, earnings compared to year ago, and forecasts) are not positive, then it’s hard for stocks to support the valuations (P/E = price to earnings) that are currently based on strong growth.

For example: A $1/share in 2016 becomes a $1.20/share in 2017 (20% YOY growth) then earns $1.25/share in 2018 (4.16% growth). It still could be a record profit – but the growth rate has slowed from 20% to 4.16%.

Since consensus estimates are for a strong earnings season, the risk as I see it is in earnings disappointment.

Lowering risk or even hedging against it can help you sleep at night. More aggressive investors may wait to see the whites of earning’s eyes before making changes, while more moderate investors may raise cash or implement a hedge position to offset market downside risk in their portfolio. It’s like putting a cushion below when you’re at the top of a ladder. It doesn’t stop you from falling, but can be the difference between a broken arm or a bruise, if you do fall off.

What about a trade war? The bottom line is I think the fear of an all-out trade war is overblown, much like the concern about a possible Euro government default was in 2011. Anxiety about a trade war seems horrible at the moment, but like spring allergies, lowering risk can be your Zyrtec until it passes.

Please Note: When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Opinions expressed are that of the author and are not endorsed by the named broker/dealer or its affiliates. All information herein has been prepared solely for informational purposes, and it is not an offer to buy, sell, or a solicitation of an offer to buy or sell any security or instrument to participate in any particular trading strategy. The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to see tax or legal advice from an independent professional advisor.

Certain statements contained within are forward-looking statements including, but not limited to, statements that are predictions of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties.