Featured Articles

It’s never too late to take the first step or get a second opinion.

Market Update- Interjections!

By Clint Gharib |

March 1, 2024 By Clint Gharib Growing up I cherished watching Schoolhouse Rock. Decades later, many of those lyrics and images still come to mind. One of my favorites has been running through my mind for many months now when looking at the markets: ‘Interjections!’ Like in the video, we’ve seen investor sentiment playing out…

Market Update – Hold, Hold… Hold

By Clint Gharib |

If you’ve seen the movie ‘Braveheart’ you know one of the famous and impactful scenes of the movie is when the English calvary, undefeated by ground troops thus far, are charging at the Scottish forces led by William Wallace, played by Mel Gibson, who four times commandingly tells his troops to Hold (scene linked to…

Market Update-

Shot Heard Round the World

By Clint Gharib |

The past two earnings seasons we’ve seen many companies decline even after reporting good earnings and raising forecasts. During my 33 years managing money, this often occurs during bouts of fear. Fear is an emotion and I’ve not found any way to predict when people’s emotions will change. It usually takes something to shake people…

Market Update-

Should I stay or Should I Go

By Clint Gharib |

Recent market panic again in April was ignited by fears of rising rates, future recession and China similarly to the prior two bear corrections (2018 q4 and 2020 q1). We are still at the crossroads that I wrote about over the past two Market Updates and thus the stock markets are battling back and forth…

Market Update – War in Ukraine

By Clint Gharib |

It’s 1am CST on Feb 23rd as I write this update. Due to the heightened anxiety over the invasion of Ukraine I felt compelled to provide this update. I am truly saddened by the actions of Russia and the horrors for many in Ukraine due to the current situation. As your advisor, it is my…

Market Update – Perspective

By Clint Gharib |

Market Update – Perspectiveby Clint Gharib January 25, 2022 There is no shortage of worries on the minds of investors and traders currently. In my November 2021 Update ‘Turn Ahead’ I wrote “I’m expecting the markets to sell off in the very short term as earnings season ends this week. I still see the same…

Market Update – Turn Ahead?

By Clint Gharib |

I’m expecting the markets to sell off in the very short term as earnings season ends this week. I still see the same 3 main forces driving asset prices though: huge amount of government stimulus (approx. $3trillion) still not in the system yet) and continued low interest rates along with solid corporate earnings reported. Because…

Market Update – Is It Time to Panic?

By Clint Gharib |

May 12th saw heavy selling in the markets. While many media pundits piled on during the decline, some perspective is needed. Currently the markets are down roughly 5% from the highs of the S&P 500 and less than 8% from the Nasdaq’s highs, not even a correction (10%) so far. Additionally, we had worse declines…

Market Update – Round She Goes

By Clint Gharib |

by Clint Gharib December 22, 2020 Two years ago, we were in the midst of the December 2018 stock market plunge that per saw the S&P 500 Index drop over 15% from its closing prices Dec 3rd through its closing price Dec 24th as reported by WSJ.com. Coming off worries over the 2018 mid-term elections…

Market Update – November Election Impact Upon the Markets

By Clint Gharib |

September 2020. Oxford Retirement Advisors Market Update – November Election Impact Upon the Financial Markets As a financial advisor for over 30 years now, I am always on the lookout for half-truths that may hurt investors. With the 2020 US general election fast approaching, we’re seeing the same old half-truth resurfacing that says investors are…

Small Business Short-Term Financing Options.

By Clint Gharib |

It might surprise you that there are times when a business owner may tap into their personal funds. If they were certain the business is sustainable after the pandemic and forthcoming economic shifts. If borrowing cash won’t put their personal household in debt. If your small business needs short-term financing but can’t find it affordably…

Market Update – Now What?

By Clint Gharib |

Market Update – Now What? March 23, 2020 There has been tragic loss of lives from Covid-19 and likely will be more before it’s over. I hope everyone takes seriously the social responsibility of following CDC guidelines to help limit the spread of the virus. Just as we take precautions to guard against the virus…

Market Update: Fire Drill or the Real Thing Pt2?

By Clint Gharib |

I can quote all sorts of numbers but this Fear vs Greed Index chart from March 9, 2020 says it all for what happened in the markets this past Monday…sheer panic. The chart is updated daily at https://money.cnn.com/data/fear-and-greed/. If you were/are fearful in the markets, you are not alone. Once again it is a FEAR…

Market Update: “What the Hell is Going On Out Here?”

By Clint Gharib |

Monday’s (August 5th) sell off had many iterating the legendary coach, Vince Lombardi’s words: “What the hell is going on out here?”. Traders worry spiked to fear that the situation with China could turn from a currency/trade war into a currency crisis (meaning Chinese panic pulling their money out of China) which would cause a…

Summer Strategies To Get Financially Fit by Oxford Retirement Advisors Integrous Investing’s Wealth Manager, Clint Gharib

By Clint Gharib |

Summer Strategies To Get You Financially Fit by Clint Gharib, Wealth Manager & Accredited Investment Fiduciary – AIF® of Oxford Retirement Advisors Integrous Investing. Summer is when our thoughts turn to vacations, toes in the sand, watermelon and backyard barbecues. It’s also a time to take a few important steps that can pay big dividends…

Clint Gharib’s 8 Tips for Talking Finances with Your Adult Children

By Clint Gharib |

Clients of Oxford Retirement Advisors Integrous Investing have asked for helpful tips they can share with their adult children on managing finances, estate planning, and particularly, what they need to know as beneficiaries. I know these conversations can be difficult to initiate, both for parents and children. Here are 8 Tips for Talking Finances with…

Oxford Retirement Advisors Wealth Management Firm and Engaging Women in Wealth!

By oxford |

Oxford Retirement Advisors Integrous Investing is announcing a new team partnership expanding its reach across the US as well as sharpening Oxford Retirement Advisors Integrous Investing’s services towards women investors. Oxford Retirement Advisors Integrous Investing Atlanta’s Wealth Management Firm has a new Business Partnership with Deb Sims of Engaging Women in Wealth! The Oxford Retirement…

Oxford Retirement Advisors Integrous Investing’s Tips For Keeping Your Financial Paperwork in Order!

By Clint Gharib |

Beyond the New Year’s Resolution: Keeping Your Financial Paperwork in Order, by Wealth Manager, Clint Gharib New Year’s resolutions can be great motivators, but any time of year is good to get your financial paperwork in order. Managing your important documents—whether electronic or on old-fashioned paper—can make your financial life easier. If this is the…

Atlanta’s Oxford Retirement Advisors Integrous Investing Announces Business Alliance with The Oxford Center for Entrepreneurs!

By oxford |

Atlanta – The newly rebranded Oxford Retirement Advisors Integrous Investing is announcing a core partnership expanding its reach across the US as well as sharpening Oxford’s services towards entrepreneurs, and small businesses. ln 2018 Atlanta financial group, Integrous Investing rebranded itself as Oxford Retirement Advisors Integrous Investing. This was part of a larger restructuring in…

2019 Smart Money Tips by Clint Gharib

By Clint Gharib |

2019 Smart Money Tips by Clint Gharib After a dramatic end to 2018, the economic outlook for 2019 is for continued volatility. Staying on track with a long-term investing strategy is key to continuing to work towards achieving your long-term goals. Another key is keeping the lines of communication open. Talking about money can be…

Oxford Retirement Advisors Integrous Investing Closing 2018 Market Update!

By Clint Gharib |

Thankfully the US stock markets were only open for a half-day of trading Dec 24th. Investors and traders alike were stuck in a frenzied sell driving the S&P 500 down to 2346. Had the bell not rung the frenzy would have driven the market even lower. Christmas day’s market closure seems to have given everyone a…

November Financial Markets: Best Two Week Gain Since February!

By Clint Gharib |

November is a strange month. It starts off with earlier sunsets and gloomy days but builds up to Thanksgiving, the holiday season kick-off. Many people I talk to tell me they have mixed feelings about November. But, I think November can be the best month of the year, money-wise. It’s a great time to look back…

Oxford Retirement Advisors Integrous Investing Market Update – Fire Drill or the Real Thing?

By Clint Gharib |

UPDATE: November 2018 Following up on my last Market Update with all the market headlines and bombastic coverage of the sell-off, the S&P 500 currently is trading around 2650 which is almost the same level as when I wrote the Market Update October 30th. Remember emotions to investing are like what drinking is to driving:…

Oxford Retirement Advisors Integrous Investing: Important Internet Safety Guide for Women

By oxford |

We oversee the Financial and Wealth Planning for a majority of female clients. These are women business owners, widowers, stay at home moms, singles and couples preparing for retirement in various stages of life. This important Internet Safety Guide is written for women, by women. News you can use from vpn Mentor. 70% of women believe online…

Oxford Retirement Advisors Integrous Investing: 6 Tips for Creating Unbreakable Passwords

By oxford |

Discover Six Recommendations for Creating Strong Passwords. You wouldn’t leave your house unlocked while you’re on a two-week vacation – so don’t leave your personal information unlocked with easy-to-guess passwords! Protecting your personal information online on a daily basis will help reduce the risk of identity theft. While most know it’s important, the majority of Americans…

Clint Gharib Oxford Retirement Advisors Integrous Investing Market Update: Turkey Is Just A Garnish

By Clint Gharib |

Currently, the markets are in rally mode after selling off the past few days on fears of a Turkish spark that could light a global debt fire slowing Chinese growth. Turkey is less than 1% of the world’s GDP and their debt is too small to sink European banks by itself. Considering China has focused…

Oxford Market Update: US-China Trade War & The Corsican Brothers

By Clint Gharib |

In Oxford Retirement Advisors Integrous Investing’s Market Update (“Aaachoo” – April 6, 2018) I wrote, “Damn the tariffs, Earnings ahead… The risk to me is earnings disappointment. I think the fear of an all-out trade war is overblown; much like the concern about a possible Euro government default was in 2011. ” Earnings for the quarter…

Summit Brokerage Services’ Circle of Excellence Conference

By oxford |

May 29, 2018 CONTACT INFORMATION: Clint Gharib 404-479-8341 Clint Gharib Attends Summit Brokerage Services’ Circle of Excellence Conference Phoenix, Arizona – Clint Gharib, Investment Advisor, AIF®, of Oxford Retirement Advisors Integrous Investing recently attended Summit Brokerage Services’ annual awards conference, aimed at bringing together advisors from across the country to celebrate the accomplishments of 2017….

Achoo! Spring 2018 Market Update, by Financial Educator Clint Gharib

By oxford |

Living in the south, we have a love-hate relationship with spring. Sure I love the warming temps and first blooms of my Camellia bush and dogwoods, but the pollen literally blankets everything causing allergic reactions to man and beast alike. My black car looks yellow, 5 minutes after I spray it off! Spring has brought the…

8 Social Security Changes You Need to Know About in 2018

By oxford |

Each year the Social Security Administration (SSA) publishes an annual fact sheet detailing changes to the Social Security program. The following changes will impact many working and retired Americans in 2018. 1) Full retirement age goes up – Americans who will turn 62 in 2018 (born in 1956) will need to wait until age 66…

Can the Party Continue

By admin |

Well it’s a new year and we have a new look to our logo and name. 2017 was one heck of an unusual and powerful year for the stock markets Unusual: It was the first year EVER that the S&P500 gained every month; also first year the NASDAQ 100 gained every month of the year. Volatility was flat…

Arch Rivals Unite – A Hasbro Mattel Marriage

By admin |

As a comic book collector, moviegoer and all around Super-Heroes fan, I’ve been watching this Hasbro Mattel merger like a kid awaiting presents on Christmas. Super excited but I don’t want to get my expectations up, and a bit worried about how it will all play out. Full disclosure we invest in Hasbro. I’ve long…

Voyage ATL article featuring Clint Gharib of Integrous Investing

By admin |

[VoyageATL] Voyage Interview Meet Clint Gharib of Integrous Investing in Sandy Springs, Georgia Please Note: When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Opinions expressed are that of the author and are not…

An Integrous Investment Tradition of Sugar Cream Pies

By admin |

Sharing sweet family memories with clients. One pie at a time. When people stop by the Integrous Investing Atlanta office during November, they usually ask “what’s up with all the pies?” It’s actually a Gharib family tradition that we’ve passed onto our clients. But not just any pie will do…here’s our story. A Family Tradition…

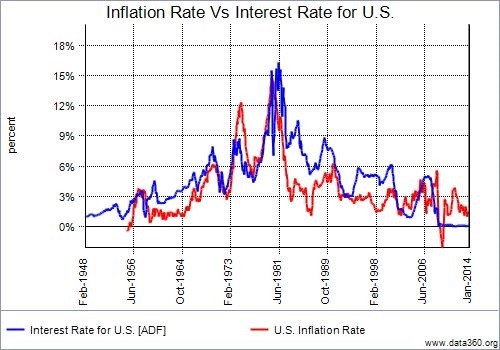

History & the Fed Are Giving You an Investment Roadmap

By admin |

I read an article recently that’s a prime example of what clients ask about and what I’m seeing in trading activity. How to invest for the age of Trump from the Los Angeles Times presented special considerations for financial advisors (such as myself) and it stated that bonds are the biggest worry. But it’s focus was…

Women & Wealth – Closing the Gender Retirement Gap

By admin |

When I was a little girl I wanted to have a job where I carried a briefcase. I remember my mom saying “then you better go to college and get a good job”. Never did she tell me that I had to ‘find a husband’ to provide this. No, she supported my dream of making…

[Forbes] A Warning Sign For Business Owners Looking For Mortgage

By admin |

Forbes – A Warning Sign For Business Owners Looking For A Mortgage. Tax Status Is Key. My Home Buying Lesson. Please Note: When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Opinions expressed…

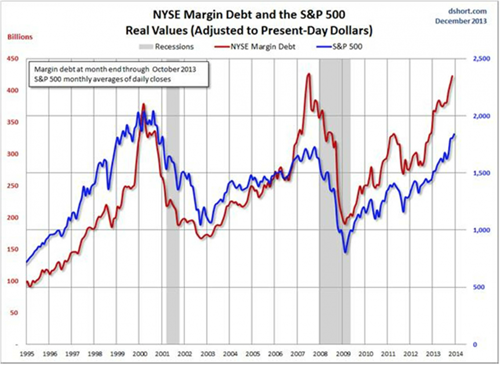

Are Stocks Trying to Copy 2013?

By admin |

It’s the 1941 anniversary of the Japanese attack on the US Naval Base at Pearl Harbor (and the return to Hawaiian shores by 104 year old survivor, Ray Chavez). It’s the date on which first state, Delaware, ratified the US Constitution in 1787, NY Philharmonic’s first concert in 1842, when Otis Redding recorded “Sittin’ on the…

Life Insurance. What’s In It For My 20-Something Year Old Self?

By admin |

In days gone by, life insurance was purchased by individuals to pay off the house or pay for college education in the event of an untimely death of a spouse. Something for “the kids” should mom or dad die early, and as a bridge of income for a surviving spouse, as it’s quite a blow…

How Do I Invest Now?

By admin |

An election brings about a lot of uncertainty for investing. Investors are flooded with predictions and outlooks from every “expert” and market observer. In May 2015 I wrote in a similarly titled blog, “I believe we are in store for an even more volatile year in 2015 than we saw the past two years. Look…

One Investment Theme Trump & Clinton Agree Upon

By admin |

Each general election cycle presents investors with the task of determining which investments could benefit from the outcome. The presidential nominees have shown that they agree on very little in regards to policies. And with an election race nearly tied in the polls, investors are left in a quandary. Such uncertainty in the past has…

Killing the Global Economy

By admin |

Lobotomies are as insane to me as the thought of negative interest rates When a seemingly quick and easy method of treating the frontal lobes of the brain was introduced “it spread like wild fire because alternative treatments were scarce. There was no other way of treating people who were seriously, mentally ill” says Dr….

Political Party Impact Upon the Markets

By admin |

As a financial advisor for more than two decades, I’m on the lookout for half-truths that may hurt investors. With the US general elections fast approaching, let me state I am politically agnostic when it comes to the major parties. I dislike both the Republican and Democratic parties, equally. One of these half-truths that re-surface…

Reshoring Jobs

By admin |

Doomsday predictions of the next market crash are appearing from the usual sources again but the vitriol coming out of campaigning politicians seems like were in 1930 instead of 2016. Consider the pitch that there is an exodus of US jobs from America – ignores the facts of reshoring (jobs returning to US that had…

NASA gives away 56 patents FREE

By admin |

Who said there’s no free lunch? NASA – National Aeronautics and Space Administration – is doing just that – they just made 56 patents available to Public Domain (free to the public) freely available for unrestricted commercial use. Here are a few examples from the recent press release: •Technologies designed to mitigate the dangerous gases created as humans…

“W’ is back

By admin |

Amidst the recent cable news coverage its hard to find any news beyond the US Presidential primaries. There is an important piece of data that has occurred quietly with little attention. The return of ‘W’. No I’m not talking about the 43rd US President but the trading pattern of US Stock markets. I put out several pieces…

Market Update- “It’s Only a Flesh Wound”

By admin |

Happy New Year. This time of the year brings out market prognostications from every source and right now many seem very negative. Rather than add to this folly I believe it’s more useful to try to make sense of the recent uncertainties. I love the “it’s only a flesh wound” scene (click to watch) in…

Apple & Denver Broncos Teach Entrepreneurs How to Get Back on Top

By admin |

December 28th – I could not believe my eyes. I just saw the chronological timeline of Apple from its early success played out by the Denver Broncos over the Cincinnati Bengals during the recent Monday Night Football game. Let me start by saying I’m a diehard Oakland Raiders FAN (as in fanatic) so it’s like…

Clint gets to discuss policies with Sen. Marco Rubio in Atlanta, GA

By admin |

Clint gets to discuss policies with Sen. Marco Rubio in Atlanta, GA On Dec 12, 2015 I enjoyed an evening with Sen. Marco Rubio. During which he discussed many topics and his plans. My conversation with him focussed on the increasing military actions of Russia and China. Beyond this, Sen. Rubio showed everyone there he…

[Forbes] Think You’re Insured? If You Don’t Have Business…

By admin |

Forbes 10/15/2015 – Think You’re Insured? If You Don’t Have Business Interruption Insurance, Think Again Please Note: When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Opinions expressed are that of the author…

“Cuba on the Cusp” – Clint was a member of the Oxford Center of Entrepreneurs’ envoy to Cuba.

By admin |

“Cuba on the Cusp” – Clint was a member of the Oxford Center of Entrepreneurs’ envoy to Cuba. I will never forget the first four days of October 2015. Thanks to the Oxford Center I was able to meet Cuban business and academic leaders within Havana. This picture of our group was taken from the…

Market Update: I love Re-Runs

By admin |

In my March 16th Market Update ‘ How Do I Invest Now’ I wrote; “I believe we are in store for an even more volatile year in 2015 than we saw the past two years. Look for more conflicting data and opinions which can lead to polarizing opinions by analysts and confusion by advisors and…

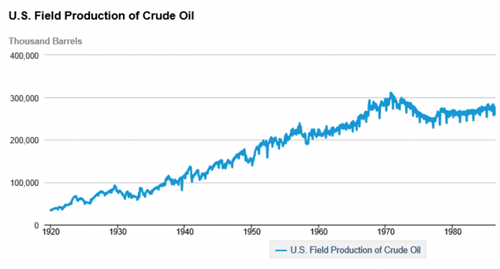

Market Update: Ducks’ Legs are Key Indicator

By admin |

Duck’s Legs are Key Indicator Thus far volatility has played its part with the oil patch being the poster child for it. The current question on the direction of oil seems to me like watching a duck on a pond, many people seem to only be watching the direction the duck is going rather…

[Forbes] Why Too Many Business Owners Bet Their Own Homes…

By admin |

[Forbes] Why Too Many Business Owners Bet Their Own Homes (And What They Could Do Differently) By Clint Gharib Please Note: When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Opinions expressed are…

Market Update – FRENZY

By admin |

Well there are always two sides to a coin. I’m writing this as the city of Atlanta is locked in the grips of a winter storm that has turned our roads into parking lots, literally, with some people stuck on roads for 5 hours or more so far. While I and my family are not…

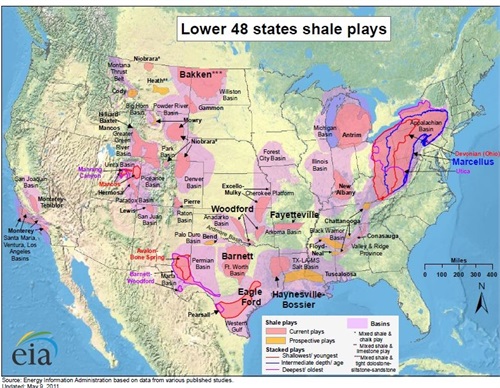

Market Update – Shale Boom Busted?

By admin |

Due to recent data and the chatter over it I felt a Market Update was needed before the next scheduled Update in August. In one of my Updates that I’ve received the most response from yet, ‘Market Update – Step Right Up, Buy a Ticket to America’s Rebirth Ride 4-11-2012’, I spoke about two major…

Market Update- America’s Rebirth: The Next Generation

By admin |

This an update to the client-favorite Market Update “Step right up and buy a ticket to America Rebirth Ride April 12, 2012”. Do you remember the seemingly forgotten headlines only a short time ago about Congressional budget battles, possible US shut-downs, US & European sovereign debt, and the uncertainty of the US dollar’s status as…

Are you working with an investment advisor, broker or both?

By admin |

Advisors follow the Fiduciary Standard which was established within the Investment Advisors Act of 1940. The U.S. Securities and Exchange Commission (SEC) Fiduciary Standard requires advisors to act in the best interest of the client – specifically stating that they must put their clients’ interests above their own. It requires higher standards and is more stringent than the suitability standard. …

Income planning evolves as much as technology. We’re at the…

By admin |

Stop and ask yourself a simple question: “What do you want your retirement to look like?” Unfortunately too many investors and advisors are held hostage to limited visions when it comes to income planning – they’re still using the same income planning approach that was based on the past 30 years and not the future. …

Oil is Dead. All Hail Oil

By admin |

I thought about titling this Update “Oil, Oil everywhere and not a certainty in sight” but there is certainty to oil just not knowledge of the future price of oil. Unless you have only watched re-run sitcoms or reality TV shows (oxy moronic to call them reality) then you know there has been a lot…

How Do I Invest Now?

By admin |

With the beginning of a new year investors are flooded with predictions and outlooks from every “expert” and market observer. It can be as confusing as navigating a busy foreign subway system when you don’t speak the language. “Uhhh… which way do I go?” Let’s not try to guess which stocks, sectors, etc are going…

Entrepreneurs Can Feast on 529’s

By admin |

Thank you America for preventing President Obama from trying to do away with 529 plans – The surest way to get people talking about something is try to take it away from them. Despite the media circus, the fact remains 529 plans should be especially attractive to entrepreneurs. Entrepreneurs are a different breed, we don’t…

Have Questions - Need Answers?

It can be difficult to make financial decisions without access to information. If you have questions or concerns about your current retirement strategy, feel free to contact us using the form below.