If you’ve seen the movie ‘Braveheart’ you know one of the famous and impactful scenes of the movie is when the English calvary, undefeated by ground troops thus far, are charging at the Scottish forces led by William Wallace, played by Mel Gibson, who four times commandingly tells his troops to Hold (scene linked to the image above). Watching his scene you can imagine the fear, doubt, & anxiousness in the hearts of the troops as they stand before a charging armored calvary, the thundering hoofs on the ground, horses snorting, men yelling, and they simply have to stand until the last moment before raising their long spears which reached the riders upon their horses and brought them eventual success on the battlefield. I continue to see this scene play out over the past few months in the markets. Like the imposing calvary made up of numerous armed and armored riders, investors are standing before a seemingly immense number of negatives (i.e., rising rates, inflation, weakening economy, geopolitical tensions, etc). Most people probably wish they were all in cash before a significant market downturn hits. I’m sure any person ever in a struggle, let alone a brutal battle like in the movie, wishes they were not present during the fight. But for those facing a struggle, like those exposed to the markets, a plan or strategy needs to be implemented. Simply closing your eyes and wishing it away is unlikely to help.

During my 33 years of managing money, I have yet to see someone who can consistently time getting completely out and back into the markets. Too often I’ve seen people who get completely out & don’t come back in until after significant rebound, higher than we they get out. So, during stressful times in the markets, re-evaluate investments you’re still holding to check the reasons you bought and own them are still intact and that they still warrant holding due to such variables as strong balance sheet, growing business, solid management to name just a few, and eliminate those where the fundamental picture (not simply price) has materially changed to the bad. Additionally, I like to also use some type of hedging for the remaining high-quality positions. Then Hold.

Unless it’s the end of the world, bad times give way eventually and a new bull market can ensue. History has shown what were the leaders before often are not what lead again. Look for best ideas so when things turn around you are ready to pounce. I’ve said multiple times this year that I think we could see a violent rally after US Midterm elections. By violent I mean steep and swift – more than what we saw in March and summer this year. Though many ideas seem attractive to me now, I think the time to raise the long spears (invest the cash) is coming soon. Hold.

Why I’m as excited as I’ve ever been in my career at the potential rally I believe could start after the US Mid-term elections

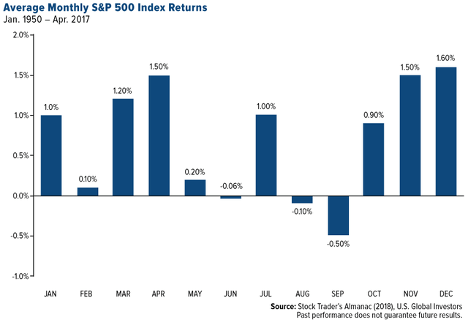

- While October is thought of for Market Crashes (1907, 1929, 1987, 2002 & 2008), the chart below shows September has been the worst month of performance on average.

- As Dan Niles said on CNBC ‘Tech Check today, “if you look at historically October is up 60% of the time for the last 70 years; the average gain is 1%. But when you go into October with the market down 15% (or more) the prior 9 months your odds of it being up go up to 83% and your average gain is about 3%.”

- History showing an average gain of 15% after 6 months from mid-term elections since 1962 per Bloomberg Data and published by US Bank this month.

- Earnings forecasts have finally begun coming down this month and many companies that have already pre-announced lowered upcoming quarterly earnings are now trading higher than when they pre-announced. Usually this is an indication of values coming into alignment with adjusted forecasts.

- We have at or near record short positions and cash in the markets – both beyond the lows in the 2008 financial crisis. Either could be a big catalyst for a rally when the tide turns.

In the movie Braveheart, the battle from the famous “Hold“ scene was a significant rally for the Scotts, but it was not the whole war. Like that scene, if there is a violent rally, I think it could be temporary, only time will tell. Should this happen as I believe, know that I’ll be on high alert to exit (learning from 2022) as many of the negatives mentioned above will still be there after.

Please call me at your convenience with any questions or to discuss this or your situation in more detail. I remain grateful for the chance to work as your advisor and strive to continue to keep your confidence. Turmoil presents opportunities and this season will pass as others have. Look to use short-term fear to your long-term advantage.

Please Note: When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Opinions expressed are that of the author and are not endorsed by the named broker/dealer or its affiliates. All information herein has been prepared solely for informational purposes, and it is not an offer to buy, sell, or a solicitation of an offer to buy or sell any security or instrument to participate in any particular trading strategy. The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to see tax or legal advice from an independent professional advisor.

Certain statements contained within are forward-looking statements including, but not limited to, statements that are predictions of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties.

The S&P 500 Index is a widely recognized index including a representative sample of 500 leading companies in leading sectors of the U.S. economy. Indexes are unmanaged and investors cannot invest directly into an index. Past performance does not guarantee future results.

Oxford Retirement Advisors is an independent firm. Securities and advisory services offered through Madison Avenue Securities, LLC (“MAS”), member FINRA/SIPC and a Registered Investment Advisor. Oxford Retirement Advisors and MAS are not affiliated entities.