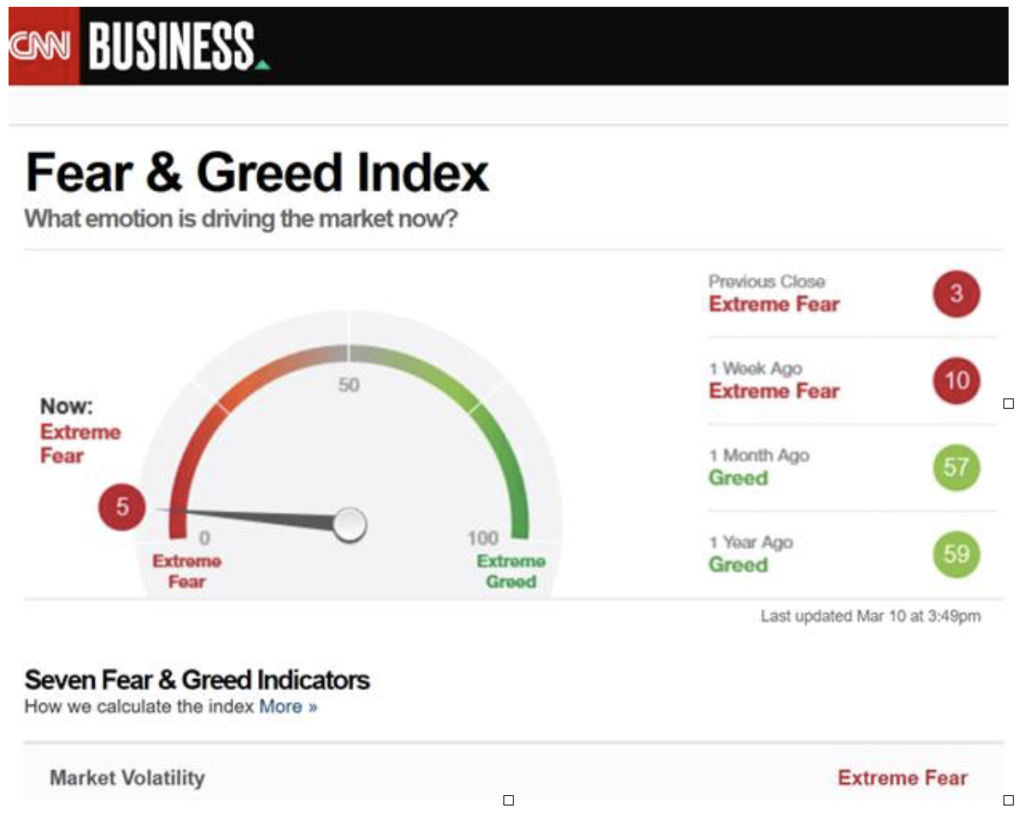

I can quote all sorts of numbers but this Fear vs Greed Index chart from March 9, 2020 says it all for what happened in the markets this past Monday…sheer panic. The chart is updated daily at https://money.cnn.com/data/fear-and-greed/. If you were/are fearful in the markets, you are not alone.

Once again it is a FEAR of the future driving activity that could not be calmed by any data or fundamentals. I have often said the single most dangerous comment in the investment world to me is “this time it’s different.” The last 24 hours I’ve been amazed at how frequent I’m hearing this from experts and investors alike. I have repeatedly talked about the Chinese corporate debt bubble as being The Game Changer variable to watch. So is this the new bear market – is the “big one” finally here? Let’s look at a key data point instead of emotions and opinions. Renowned market technician, Carter Worth of Cornerstone Macro who I highlight often, put together a chart (below) on CNBC ‘s Fast Money show Monday (3/9/20) showing the S&P 500 Index has traded in channel since the lows of the Financial Crisis of 2009 till now.

Just as you game plan for football

Investors need a plan of action too

The index broke above the trading channel a month before the vicious sell-off we experienced at the end of 2018. This happened again this February before the current vicious sell-off again. So far this sell-off has remained within the trading channel that we have been in since the lows of 2009. Looking at the chart below you see the S&P 500 (in this case) would have to break below 2500 to change the channel or band we’ve been in for almost 11 years now.

On November 2nd 2018 I penned the Market Update “Fire Drill or the Real Thing?” which can be applied today. Suffice to say fear and hope are not sound investment strategies. Only time will tell if this is another sell-off that is a buying opportunity within a bull market OR if it’s the first round of a new bear market.

It’s too early to know if March 9th’s panic was the low and this was another correction within a long bull market like was the case in 2011, 2014, 2016 and q4 2018. But, if the S&P 500 should break below 2500 before quarterly earnings which starts in a few weeks, then I believe that is a signal that this sell-off is a whole new bear market with more downside ahead and would seek to reduce risk considerably and implement portfolio hedging much stronger in anticipation of dropping to the next support level on the charts.

Remember emotions are to investing like alcohol is to driving: a terrible mix. Keep in mind that your financial plan accounts for market swings like we’ve had and will continue to experience. This recovery may take weeks or months but that’s why we have your short-term needs covered. Not because of this sell-off today, but because there will always be some sort of event that can disrupt the markets in the short term.

The bottom line is that we don’t know when this will pass, but it will, and rather than speculate or guess, I’ll continue to rely on data and look to use short-term fear to gain long-term potential. Please read more at Oxford Retirement Advisor website: How to invest with strategy not fear.

Please Note: When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Opinions expressed are that of the author and are not endorsed by the named broker/dealer or its affiliates. All information herein has been prepared solely for informational purposes, and it is not an offer to buy, sell, or a solicitation of an offer to buy or sell any security or instrument to participate in any particular trading strategy. The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to see tax or legal advice from an independent professional advisor.

Certain statements contained within are forward-looking statements including, but not limited to, statements that are predictions of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties.

The S&P 500 Index is a widely recognized index including a representative sample of 500 leading companies in leading sectors of the U.S. economy. The Nasdaq 100 Index is made up of the 100 largest non-financial companies traded on the Nasdaq stock exchange. These indexes are unmanaged. Investors cannot invest directly into indexes. Past performance does not guarantee future results.