Market Update – Perspective

by Clint Gharib January 25, 2022

There is no shortage of worries on the minds of investors and traders currently. In my November 2021 Update ‘Turn Ahead’ I wrote “I’m expecting the markets to sell off in the very short term as earnings season ends this week. I still see the same 3 main forces driving asset prices though: huge amount of government stimulus (approx. $3trillion) still not in the system yet) and continued low interest rates along with solid corporate earnings reported. Because of these, I believe that any near-term sell-off can be another buying opportunity as I think the markets will rally again into the new year. Next summer is where it seems to me that I’ll change the investment strategy from high growth companies to either defensive or inflationary.” I’ll be the first to admit that I didn’t foresee this steep of decline, literally a panic, in the high growth stocks. I don’t know what else to call the drop over the past few months in High Growth stocks. The decline in January in the general stock markets is more what I expected. Considering markets negligible reaction when Russia took over Crimea in 2014 Q1, the current pummeling declines seem to me to stem primarily from the fear of rising rates. It’s like markets are looking at the threat of rising rates through a magnifying glass rather than seeing them as they are: still historically low.

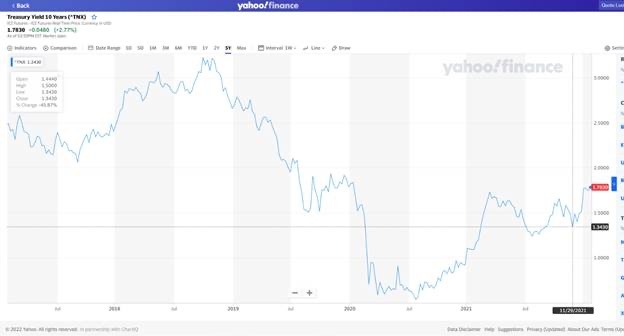

In the past few weeks, I’ve heard multiple declarations by “experts” in the media that seem void of perspective like when you’re talking football with a young fan who declares a RB with two seasons under their belt is the greatest running back ever, completely void of the knowledge of Jim Brown, Walter Payton or, dare I say, Jim Thorpe, who’s statue greets visitors to the NFL Hall of Fame. Probably the most irritating to my ears was one regular guest trader who spouted this past Friday that she’d never seen interest rates rise at this rate of acceleration in her career. What?! Currently the 10yr US Treasury yield has gone from 1.34% at the beginning of November (2021) to 1.78% as of Jan 24th as I write this. Yet without even going all the way back to 2020 Q3, consider from mid Aug 2021 to mid Oct 20yields jumped from 1.26 to 1.65%.

It seems like investors are reacting to the thought of rising rates like it’s the hyper-inflation of the late 1970’s. Just a year ago many were worried about deflation. Ok so the US Federal Reserve is looking to raise interest rates this year. I’ve read predictions ranging from 3 to 6 rate hikes for this year alone. I think those making prognostications need to follow Jonny Diaz’ song ‘Just Breath.’ Many don’t seem to recall or maybe even know that the US Federal Reserve raised rates 17 consecutive times during June 2004 through June 2006 as inflation stayed stubbornly low despite rapid, repeated rate hikes then. There is no shortage of articles available since discussing the lessons learned from then to raise rates slowly and steadily which does not appear lost on current Fed Chair Powell.

Based on conversations I’ve had with a few nervous investors; it seems fitting to remind everyone that the stock markets are forward looking so, if you’re hearing about a worry in the stock markets on the evening “expert” roundtables it’s likely already been factored into stock markets. Surprisingly I’m not hearing many talking about the 10th Chinese property firm default, Shimao, this month. What makes this one stand out to me is that Shimao was supposedly “safe from default” having successfully passed Chinese stress tests late last year. As I’ve written frequently over the past 10years China’s growing debt monster is one of the most important factors that bears watching closer. We have now seen multiple cracks from seemingly increasing defaults (Shimao is the 10th reported default since Evergrande). If China suffers further economic decline, which I believe is likely, that could be deflationary.

That said, the same three tail winds to the markets remain that I’ve discussed before: solid corporate earnings so far into this earnings season, low rates and historically high levels of liquidity. Obviously only history will tell us if the current levels are a near term bottom, but it seems to me based on all available data that investors have overreacted again to the fear of rising rates. As I said to several people today, if your timeframe is more than a year or two, I’m like a kid in a candy store looking at opportunities in the markets right now. So, I encourage everyone to take a deep breath and just breathe, revisit the goals for their various investments and look to data not emotions to drive investment decisions. Remember emotions are to investing like drinking is to driving: a terrible mix.

I remain Thankful to work for you as your advisor and strive daily to keep your trust and confidence to manage assets for you. I wish you and yours a joyous week ahead. Please visit www.OxfordRA.com for additional commentary.

Opinions expressed are that of the author and are not endorsed by the named broker/dealer or its affiliates. All information herein has been prepared solely for informational purposes, and it is not an offer to buy, sell, or a solicitation of an offer to buy or sell any security or instrument to participate in any particular trading strategy. The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to see tax or legal advice from an independent professional advisor.

Certain statements contained within are forward-looking statements including, but not limited to, statements that are predictions of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties.

The S&P 500 Index is a widely recognized index including a representative sample of 500 leading companies in leading sectors of the U.S. economy. The Nasdaq 100 Index is made up of the 100 largest non-financial companies traded on the Nasdaq stock exchange. These indexes are unmanaged. Investors cannot invest directly into indexes. Past performance does not guarantee future results.

Oxford Retirement Advisors is an independent firm. Securities and advisory services offered through Madison Avenue Securities, LLC (“MAS”), member FINRA/SIPC and a Registered Investment Advisor. Oxford Retirement Advisors and MAS are not affiliated entities.