I’m expecting the markets to sell off in the very short term as earnings season ends this week. I still see the same 3 main forces driving asset prices though: huge amount of government stimulus (approx. $3trillion) still not in the system yet) and continued low interest rates along with solid corporate earnings reported. Because of these, I believe that any near-term sell-off can be another buying opportunity as I think the markets will rally again into the new year. Next summer is where it seems to me that I’ll change the investment strategy from high growth companies to either defensive or inflationary.

The reason I say by summer is the very 3 forces mentioned above driving asset prices could all reverse then. By summer, many policies implemented by the current US administration seem likely to me to impact corporate profits, interest rates could rise beyond the 2% threshold (key to wall street outlook) and government frenzied spending may stop with the mid-term elections.

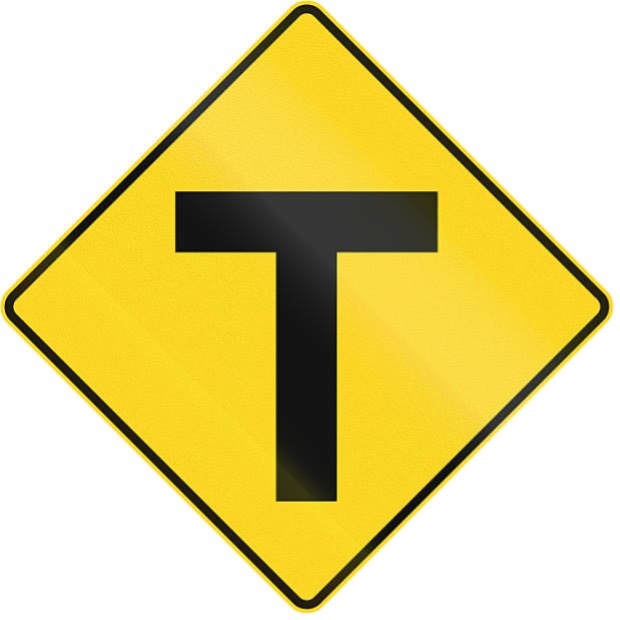

As to whether the possible new strategy may be ‘defensive’ or ‘inflationary’ to me is determined by China’s debt issues. If China can continue whistling past the graveyard of their debt problems, then inflation could really become apparent. On the other hand, if their debt cracks turn into a debt break, then that could be recessionary to China and thus the global economy, especially Europe (Germany in particular), Australia and Latin America, and thus I’d look to defensive names and away from inflationary ideas. Kind of like approaching a “T-intersection”: I know I’m going to have to turn; I just don’t know which way yet. I take comfort knowing that I see many investment opportunities for either change.

I remain Thankful to work for you as your advisor and I wish you and yours a healthy and blessed new year.

Please visit www.OxfordRA.com for additional commentary.

Opinions expressed are that of the author and are not endorsed by the named broker/dealer or its affiliates. All information herein has been prepared solely for informational purposes, and it is not an offer to buy, sell, or a solicitation of an offer to buy or sell any security or instrument to participate in any particular trading strategy. The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to see tax or legal advice from an independent professional advisor.

Certain statements contained within are forward-looking statements including, but not limited to, statements that are predictions of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties.

The S&P 500 Index is a widely recognized index including a representative sample of 500 leading companies in leading sectors of the U.S. economy. The Nasdaq 100 Index is made up of the 100 largest non-financial companies traded on the Nasdaq stock exchange. These indexes are unmanaged. Investors cannot invest directly into indexes. Past performance does not guarantee future results.

Oxford Retirement Advisors is an independent firm. Securities and advisory services offered through Madison Avenue Securities, LLC (“MAS”), member FINRA/SIPC and a Registered Investment Advisor. Oxford Retirement Advisors and MAS are not affiliated entities.